Governance Initiatives

Risk Management

The Asset Management Company serves as the financial instruments business operator that manages FRI’s assets. In this role it has created the Risk Management Regulations to help ensure the soundness of business operations and, fully aware of the importance of comprehensive risk management, works to appropriately manage each type of risk and to minimize risk. This stance serves as the basis of its management.

Risk Management Framework

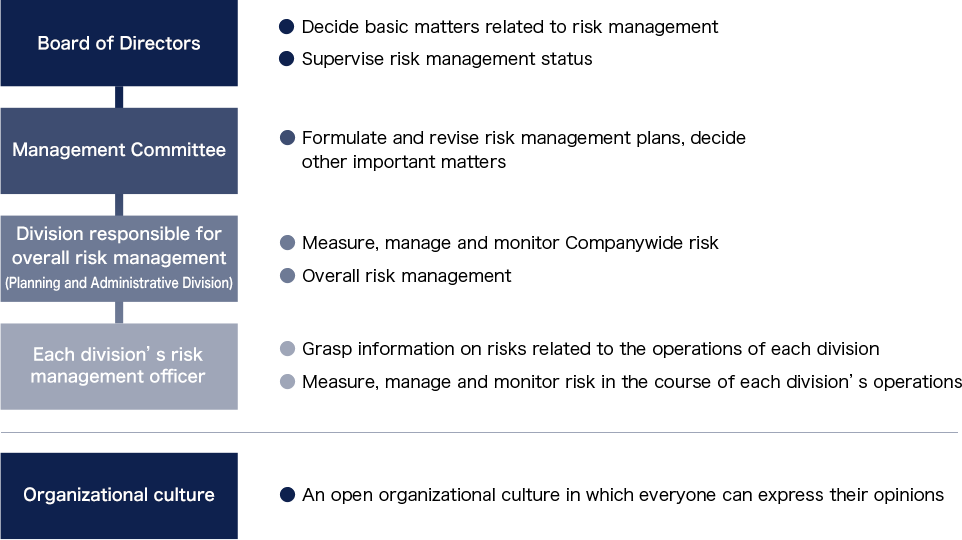

The Asset Management Company carries out risk management based on the following framework.

The Asset Management Company has established a basic rationale regarding risk management along with the Risk Management Regulations for its internal risk management system, and it has put in place management systems based on the regulations and appropriately manages the various types of risks.

In addition, in order to manage risks regarding conflicts of interests, the Asset Management Company has set forth regulations on transactions with interested parties and strictly established the Rules Concerning Conflicts of Interest.

When establishing and abolishing the Risk Management Regulations that stipulate basic matters of risk management, the Risk Management Company is required to have such decisions determined by the Board of Directors after the matters have been dealt with by resolution by the Management Committee. For the specific methods for conducting risk management, the Asset Management Company formulates a risk management plan to establish the priority items to be monitored for each type of risk along with the countermeasures that should be taken, and it conducts management after the plan thereof has been dealt with by resolution by the Management Committee. The results of implementing such risk management plan are reported to the Management Committee, the Board of Directors and also the Investment Corporation’s Board of Directors.

Under the Asset Management Company’s internal risk management framework, the general managers of each division serve as the risk management officer for their respective division, while the Planning and Administrative Division, which is the division responsible for overall risk management, carries out integrated risk management.

The Role of Risk Management Plans

The Asset Management Company regards risk management and compliance as integral to management strategy and organizational culture and, as one of its management tasks, works to carry out risk management plans in coordination with internal audit plans.

For detailed information regarding compliance, please refer to the following page.