Governance Initiatives

Compliance

FRI and Mitsui Fudosan Frontier REIT Management Inc., the asset management company (the “Asset Management Company”), which are bearers of the listed investment corporation system that plays the role of the financial brokerage system through the securities market, position compliance as the fundamental principle for business operations and proactively work to promote compliance.

The Asset Management Company has established the compliance regulations as its internal rules, in which it defines compliance as “implementing corporate activities with integrity and in a fair manner, fully understanding the social norms as well as strictly abiding by all laws relating to its operations, various regulations, internal rules and market rules.” By incorporating the function to promote compliance into its corporate governance system, it endeavors to ensure appropriate asset management and protect investors.

FRI, in close coordination with the Asset Management Company, implements fair and highly transparent asset management operations through appropriate administration of the Board of Directors and other bodies.

Establishment of system to eliminate anti-social forces

The Asset Management Company shall prepare a manual to cope with anti-social forces as its internal rules, and establish a company-wide system to eliminate anti-social forces. As part of such a system to eliminate them, all officers and employees of the Asset Management Company shall review and assess the attributes of its business partners and shareholders upon initiating transactions as well as confirming the identity of such parties, in order to avoid all involvement, transaction and use of any kind of anti-social forces.

Rules concerning conflicts of interest

The Asset Management Company has determined Rules Concerning Conflicts of Interest regarding transactions with parties.

Rules Concerning Conflicts of Interest (204KB)

Compliance Promotion Framework

The Asset Management Company promotes compliance based on the following framework.

| Organization | Main roles | ||||||

|---|---|---|---|---|---|---|---|

| Board of Directors |

|

||||||

Compliance Committee

|

|

||||||

| Compliance Division |

|

||||||

| Each division’s compliance officer |

|

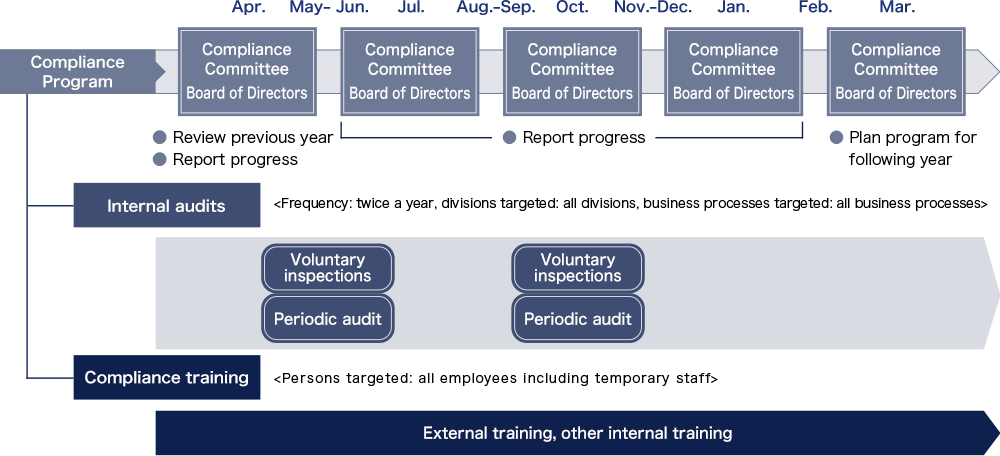

Annual compliance program

Internal audits

Internal audits target all divisions: Investment Division, Finance Division, Planning and Administrative Division, and Compliance Division. For those internal audits, the Compliance Division General Manager performs the role of the internal audit officer for the Investment Division, Finance Division, and Planning and Administrative Division, while the Planning and Administrative Division General Manager performs that role for the Compliance Division.

Every year, we have an audit plan formulated for the purpose of regular audits, which are conducted twice a year. These consist of the overall audit, which is carried out with assistance from a service provided by an entrusted external party, a follow-up to that audit, and audits that monitor voluntary inspection items, etc. The internal audits are carried out based on the audit plan, and their results are compiled into an internal audit report, which is presented to the Chief Executive Officer and Representative Director, the Board of Directors, and the Compliance Committee. Based on the results of the internal audit, follow up action is then carried out as necessary, including reflecting such results in compliance programs.

Compliance training

The asset management company continue to provide compliance training for all executives and employees with the aim of improving compliance awareness and forming an organizational culture that emphasizes compliance.

Training track details

| FY2022 | FY2023 | FY2024 | FY2025 | FY2026 | |

|---|---|---|---|---|---|

| Compliance general remarks | 1 time | ||||

| Conflicts of interest | 1 time | ||||

| Conflicts of interest (examples) | 1 time | ||||

| Information management (personal information, insider trading) | 1 time | ||||

| Trends in financial administration, securities monitoring | 1 time | ||||

| Elimination of relationships with antisocial forces/grievances, etc. | 1 time |

Policy concerning the anti-fraud and political involvement

The Asset Management Company has determined Rules Concerning Conflicts of Interest regarding transactions with parties.

- Anti-bribery

The Asset Management Company will keep our relationship with related parties and business partners within a socially acceptable scope, and will not have a relationship that may raise suspicion or distrust from society. - Anti-corruption

The Asset Management Company will establish a code of conduct concerning the “elimination of antisocial forces,” “prevention of money laundering,” “appropriate management of conflicts of interest,” “prohibition of insider trading,” etc., and will work to thoroughly observe compliance and prevent corruption. - Political involvement

The Asset Management Company will not make donations for the political activities of those other than political parties and political funding organizations. In the event that we support or make political donations to political parties or political funding organizations, we will observe laws and regulations, such as the Political Funds Control Act and the Public Offices Election Act.

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|

| Number of cases of corruption being exposed | 0 | 0 | 0 | ||

| Amounts of money paid in fines, charges, and settlements related to corruption (yen) | 0 | 0 | 0 | ||

| Punishments or dismissals related to corruption | none | none | none | ||

| Total amount of money in political donations (yen) | 0 | 0 | 0 |

Establishment of compliance consultation desk (fraud prevention, etc.) and structure for collecting grievances

Consultation desks have been established both inside and outside the Asset Management Company based on the internal consultation and whistleblower system regulations. The Asset Management Company has a system in place where executives and employees are able to anonymously report to the Compliance Division General Manager or an external legal firm on acts in violation of laws and regulations at an organizational level or at an individual level (acts in violation of lays, or internal company rules such as the code of ethics or compliance manuals, or acts under suspicion of such violation). Under these same regulations, it is forbidden to treat whistleblower unfairly, which includes such measures as protection of whistleblower information and the prohibition on taking retaliatory action, and the Company is obligated to decide on and implement appropriate measures concerning the reported content.

The consultation seeker or whistleblower is protected by the Whistleblower Protection Act and cannot be treated unfairly by the Company based on the matters discussed in the consultation or whistleblowing.